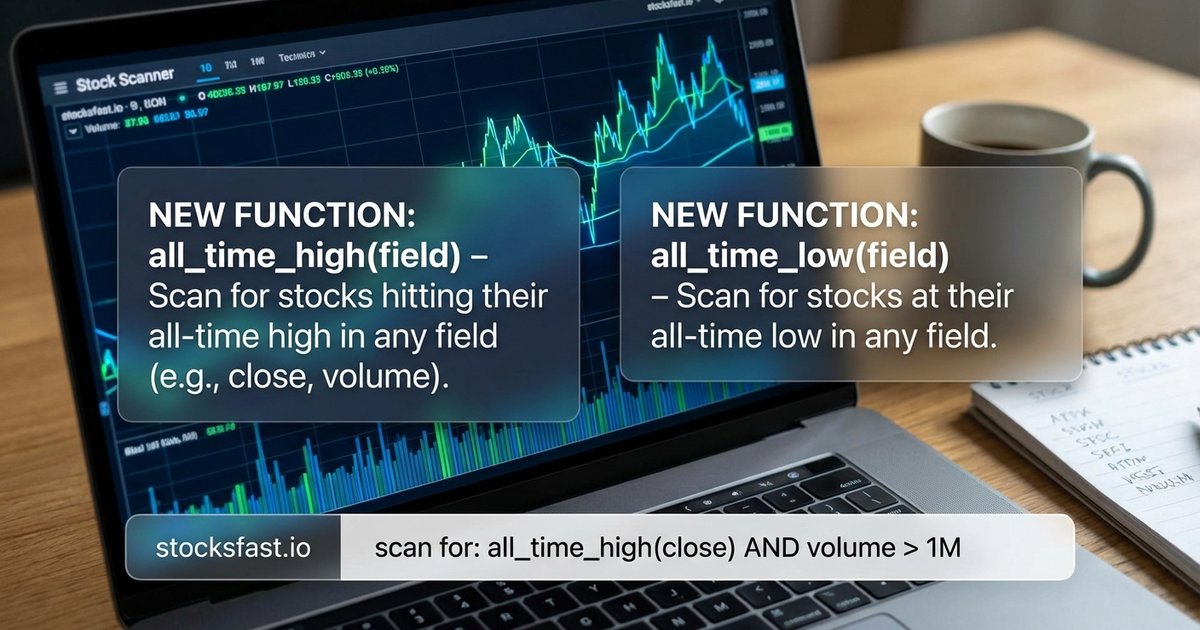

We've added two new functions to StonQL: all_time_high() and all_time_low(). They do exactly what the names suggest - track the highest and lowest values a stock has ever reached.

What They Do

all_time_high(field) returns the maximum value of any field from the first trading day to the current bar. all_time_low(field) does the opposite - the minimum value across the entire history.

Simple syntax:

all_time_high(high); // Highest price ever

all_time_low(low); // Lowest price everFinding Stocks Near All-Time Highs

Stocks making new highs or trading near them tend to continue higher. Here's a scan for stocks within 5% of their all-time high:

volume * close > 10M;

close > all_time_high(high) * 0.95;For actual breakouts - stocks making new all-time highs today:

volume * close > 10M;

high > all_time_high(high)[1];Add volume confirmation to filter out weak breakouts:

volume * close > 10M;

high > all_time_high(high)[1];

volume > sma(volume, 20) * 1.5;Finding Stocks Near All-Time Lows

Contrarian traders look for beaten-down stocks showing signs of life. Or maybe you think "low can always go lower". Stocks within 10% of their all-time low:

volume * close > 10M;

close < all_time_low(low) * 1.10;Near all-time low but showing reversal - oversold RSI starting to turn:

volume * close > 10M;

close < all_time_low(low) * 1.05;

rsi(close, 14) < 30;

close > open;New All-Time High Close

You don't have to limit yourself to just high or low fields. You can also use close if you only care about a closing basis.

// new all-time high close

close > all_time_high(close)[1];

// alternative implementation:

close == all_time_high(close);All-Time High Volume

Just like price fields, you can also use the volume field in your filters.

Find stocks with the highest-ever daily volume:

volume == all_time_high(volume);Historical Range Position

Combine both functions to see where a stock sits in its entire price history. This scan finds stocks in the upper 20% of their historical range:

volume * close > 10M;

ath = all_time_high(high);

atl = all_time_low(low);

position = (close - atl) / (ath - atl);

position > 0.80;The lower 20% - potentially oversold relative to history:

volume * close > 10M;

ath = all_time_high(high);

atl = all_time_low(low);

position = (close - atl) / (ath - atl);

position < 0.20;Distance from Extremes

Find stocks that have pulled back significantly from highs - useful for catching retracements:

volume * close > 10M;

ath = all_time_high(high);

(close - ath) / ath < -0.20; // 20%+ below ATHOr stocks that have recovered substantially from their lows:

volume * close > 10M;

close > all_time_low(low) * 2.0; // Doubled from ATLCombining with Momentum

ATH breakout with momentum confirmation:

volume * close > 10M;

high > all_time_high(high);

rsi(close, 14) > 60;

macd_histogram(close, 12, 26, 9) > 0;Cross-Timeframe Analysis

Both functions work inside mtf() blocks. Weekly all-time high for catching false breakout above weekly all-time high:

// weekly all-time high as of prior weekly bar

weekly_ath = mtf("1W") { all_time_high(high)[1]; };

// daily timeframe: false break above, close red

high > weekly_ath and close < weekly_ath and close < open;Technical Notes

These functions require full price history - they look back to the very first trading day for each stock scanned.

The values are monotonic: all_time_high() never decreases over time, and all_time_low() never increases.

Available now in the scanner.