Find your exact trade setup in seconds.

A next-generation stock screener powered by StonQL™ — a language built for scanning.

- Scan 5000+ stocks across ALL timeframes.

- Express complex criteria with precise syntax.

- Never miss a setup.

It's 2026, and you're scanning the market with dropdowns?

Traditional screeners force you into their rigid boxes. Pick an indicator. Pick a comparison. Pick a value. Repeat. Hope it's enough.

Meanwhile, the setups you actually trade — the ones you see on the chart — can't be expressed in dropdown menus. So you scan for something close, then manually filter hundreds of results.

StocksFast lets you describe exactly what you're looking for, in precise language that describes the condition you're searching for.

rsi(close, 14) > 50; ema(close, 8) > ema(close, 21); close > high[1];

You See the Setup. Now Scan for It.

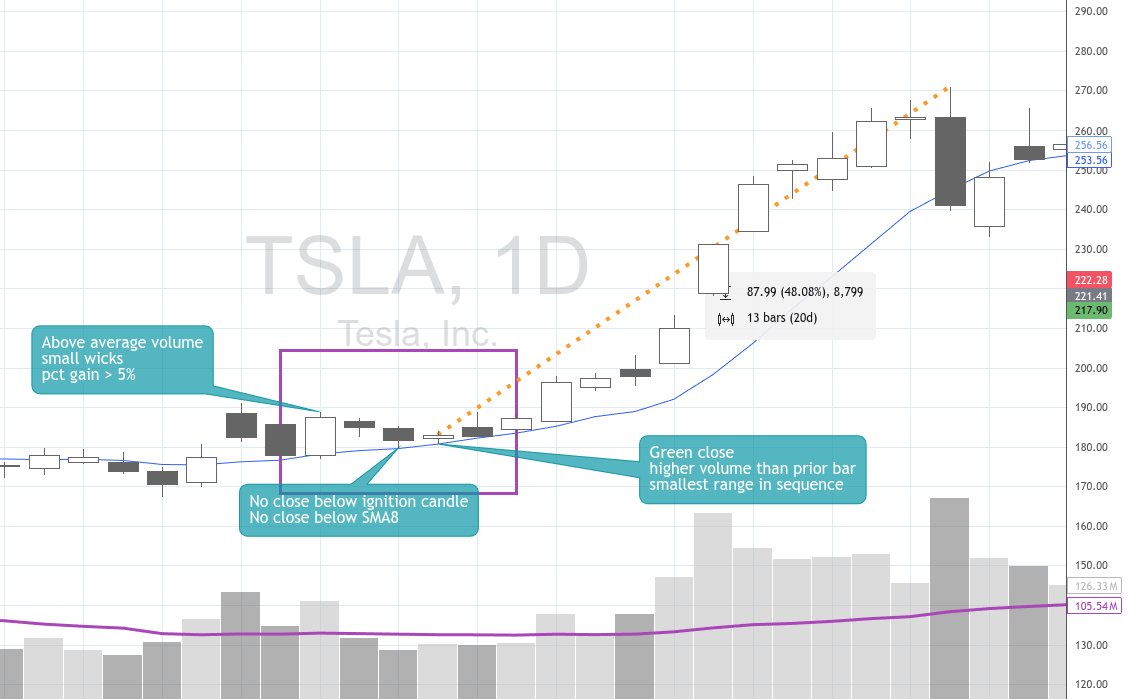

This is a real TSLA chart. The pattern? An ignition bar with volume, followed by a controlled pullback, then a compression bar signaling continuation.

With StockFast, you describe exactly what you see — and find every stock showing the same setup, right now.

/* ignition bar */ roc(close, 1)[3] >= 5; // minimum 5% gain volume[3] > sma(volume, 30)[3]; // initiation bar on high volume close[3] > sma(close, 8)[3]; // close above 8SMA /* pullback bar 1 */ close[2] < open[2]; // red bar volume[2] < volume[3]; // lower volume than ignition bar high[2] < high[3]; // lower high than ignition bar low[2] > low[3]; // stays above initiation bar low close[2] > sma(close, 8)[2]; // close above 8SMA /* pullback bar 2 */ close[1] < open[1]; // red bar volume[1] < volume[3]; // lower volume than ignition bar volume[1] < volume[2]; // falling volume from first pullback bar low[1] > low[3]; // doesn't pierce ignition bar close[1] > sma(close, 8)[1]; // close above 8SMA /* increasing volume compression bar */ close > open; // green close volume > volume[1]; // increasing volume high <= high[1] and low >= low[1]; // inside bar

One Language. Every Timeframe.

Daily. Weekly. Monthly. Quarterly. Even exotic periods like 2D, 3D, or 4W. Write once, scan anywhere.

Build your universe on higher timeframes — filter for stocks in long-term uptrends on the monthly chart. Then drop down and trigger entries on daily setups. Same syntax, different lens.

Multi-timeframe analysis without the mental gymnastics.

Watchlists That Work With You

Watchlists aren't an afterthought — they're central to how StocksFast works.

- →Import/export with TradingView and other platforms

- →Limit scans to your universe — skip the noise

- →Add matches directly to watchlists from scan results

- →Cull stocks you've reviewed to keep lists tight

Scan in Layers. Keep What Works.

Run a scan. Your matches stay selected. Switch timeframes, add another filter, run again — only stocks that pass every layer make the cut.

- →Start wide on the monthly chart

- →Layer weekly setups, then daily triggers

- →Watch 5,000 stocks become 50, then 5

- →Save to watchlist when you're done

50+ Ready-to-Use Scans

Explore expressions across popular trading strategies. Copy, tweak, make them yours.

The Math (R=$250)

One missed trade captured.

One timely exit.

One year paid.

Ready to stop leaving money on the table?

No credit card required